Our pets may be notorious for hogging the bed, but that’s not the only way they can interfere with our sleep. Some pet parents may also be lying awake with worry.

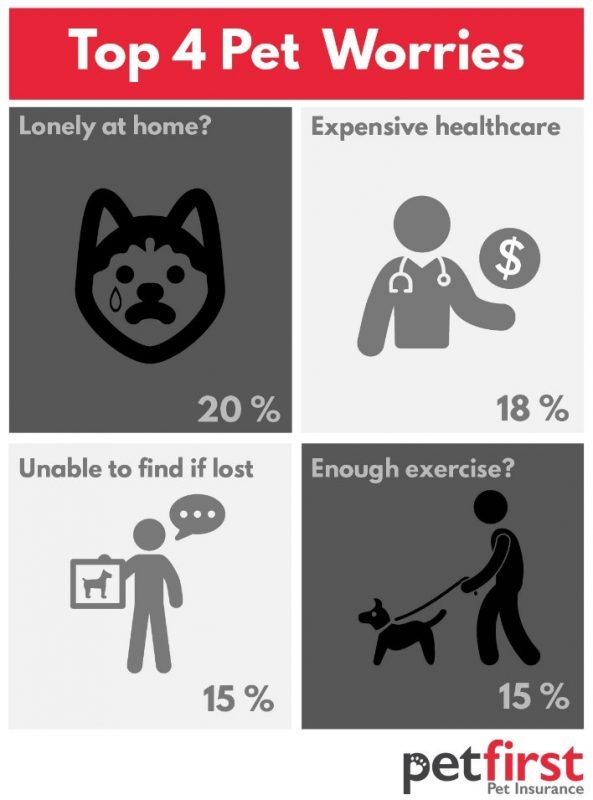

We recently polled PetFirst Pet Insurance policyholders and found that more than 40% worried a lot about their pets – and unexpected medical expenses [1] was the second most commonly cited worry.

The number one worry[2]? That

Their Pet Was Lonely During the Day

The PetFirst poll lined up with a recent Lending Tree survey which found that 41 percent of millennials had pet-related debt. Among the expenses was emergency veterinary care – with six out of ten millennials reporting that they had been confronted with a pet emergency.

Why is this happening?

There’s a couple of reasons.

First, people are more likely to view their pets as “one of the family” – and that means taking them to an emergency room or specialist when they are sick.

Second, as medical care has improved, more extensive, intensive (and expensive!) options are available.

Just recently, one of our policyholders submitted a claim for nearly $2,000, after their dog was bitten while playing at a dog park. We’ve also paid more than $10,000 in claims for one French Bulldog, who had to have nasal cysts and a tumor removed. The dog, Wally, had a rough year, but is doing great now and can be followed at @WallyWeeto on Instagram.

A recent story in The Outline shared stories of difficult decisions that pet owners have faced when their pet needed expensive care. One woman said she considered selling some of her furniture to help pay for a $1,500 heartworm treatment. While the vets interviewed in the story said most owners are likely to consider several factors – the pet’s life expectancy, for example – when evaluating a treatment plan. But the cost is certainly a big factor.

We often hear from policyholders who are faced with the choice between an expensive surgery that could correct a problem or long-term pain management, which could cost as much in the long run but wasn’t as challenging of an expense upfront.

Let’s be clear.

No one should feel guilty about making a reasonable, loving decision to end treatment. Often, it’s the humane thing to do – in some cases, treatments may seem to only extend suffering.

But all of us want to be able to make those decisions without also silently calculating the cost. That is why pet insurance is attractive to many people and growing rapidly as an industry.

Last year, the number of pets insured grew by 18% in the United States, with more than 2 million pets insured, according to The North American Pet Health Insurance Association.[3]

Our poll of PetFirst policyholders found that 30% of them chose to get pet insurance for that reason – “I don’t want to have to make tough decisions about my pet’s care due to finances.”

And 16 percent said that it was experiences like that in the past, that prompted them to get pet insurance.

Nearly 90 percent of respondents – all of whom had pet insurance – said having insurance helped reduce their worry, though they still – of course – would like to avoid a pet emergency.

Sometimes there’s no escaping worry; we worry about those we love. In addition to worrying about pet’s medical bills, we also worry about whether they’re getting out of the house enough, whether we could find them if lost, and whether they are going to get along with our new dating partner or child. Love is the worry.

The best worry is that which prompts you to be proactive. Whether that means, starting a new exercise regime with your pet, investing in a microchip, opening a savings account – or signing up for pet insurance – taking steps now can help you ease those worries.

[1] PetFirst Policyholder Poll, 2019

[2] PetFirst Policyholder Poll, 2019

[3] NAPHIA State of the Industry Report, 2019

About PetFirst

PetFirst Pet Insurance, a MetLife company, was founded in 2004. PetFirst is dedicated to removing personal financial considerations from pet care. By providing affordable pet health insurance to families, PetFirst helps ensure that their pet is covered in the event of an accident or illness. To learn more, please go to petfirst.com